Top Pharmaceutical Exporting Countries in 2026.

Who’s Leading the Global Medicine Market?

In 2025, pharmaceuticals continue to be one of the most valuable and fast-growing global industries. From life-saving vaccines to chronic disease treatments, medications are more essential than ever. But have you ever wondered which countries are producing and exporting the majority of these vital drugs?

Let’s take a closer look at the top pharmaceutical exporting countries in 2025, what drives their dominance, and how they’re shaping the future of global healthcare.

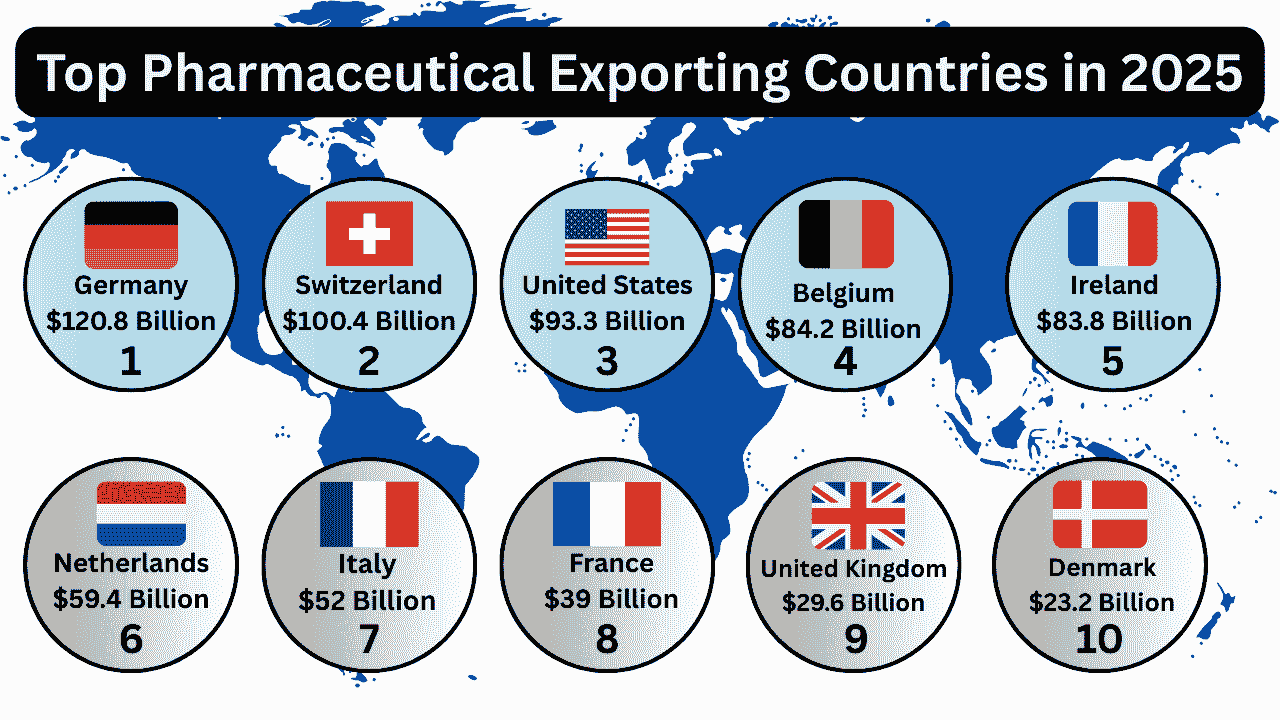

Top 10 Pharmaceutical Exporters in 2025

| Rank | Country | Pharmaceutical Exports (USD) |

| 1 | Germany | $120.8 Billion |

| 2 | Switzerland | $100.4 Billion |

| 3 | United States | $93.3 Billion |

| 4 | Belgium | $84.2 Billion |

| 5 | Ireland | $83.8 Billion |

| 6 | Netherlands | $59.4 Billion |

| 7 | Italy | $52 Billion |

| 8 | France | $39 Billion |

| 9 | United Kingdom | $29.6 Billion |

| 10 | Denmark | $23.2 Billion |

Why These Countries Lead the World in Pharma Exports

Germany – $120.8 Billion

Germany takes the top spot, thanks to its unmatched industrial capacity and pharmaceutical manufacturing expertise.

Switzerland – $100.4 Billion

Don’t let Switzerland’s size fool you. With pharmaceutical titans like Novartis and Roche headquartered here, the country specializes in high-value, innovative drugs. Strong intellectual property laws and a stable economy also attract major investments.

United States – $93.3 Billion

The U.S. is the global powerhouse of biotech and drug discovery. While it has a massive domestic market, exports are rising, especially in high-tech treatments and vaccines.

Belgium – $84.2 Billion

Many people are surprised to learn that Belgium plays a central role in Europe’s pharmaceutical logistics. With its world-class infrastructure and vaccine manufacturing, it’s a vital link in the global supply chain.

Ireland – $83.8 Billion

Ireland has become a pharmaceutical haven. With low corporate tax rates and a skilled workforce, it hosts production facilities for most of the world’s top pharma companies. The result? Massive exports to markets worldwide.

Netherlands – $59.4 Billion

The Dutch pharmaceutical scene thrives on efficiency. Leveraging Rotterdam’s port and top-tier distribution networks, the Netherlands specializes in generics and essential medicine production.

Italy – $52 Billion

Italy blends old-school manufacturing strength with modern biotech. The country has also ramped up vaccine production, becoming an important player in pandemic preparedness.

France – $39 Billion

France is a steady force in pharma, home to global brands like Sanofi. Strong R&D, public-private partnerships, and EU trade ties help maintain its export competitiveness.

United Kingdom – $29.6 Billion

Despite Brexit, the UK continues to lead in drug innovation, especially in biotech. Institutions like Oxford fuel cutting-edge research and collaborations with global pharma brands to keep exports flowing.

Denmark – $23.2 Billion

Denmark ranks in the top 10, driven largely by Novo Nordisk’s dominance in diabetes care and hormone therapy. High-quality production and innovation make it a key exporter.

Quick FAQ: Understanding Pharma Exports in 2025

Q1: Why is Germany #1 in pharma exports?

Its industrial strength, global brands, and central EU location make it a global leader.

Q2: How is Switzerland so strong despite its size?

It focuses on high-value drugs and is home to pharma giants like Novartis and Roche.

Q3: Is the U.S. more focused on local consumption?

Historically, yes, but exports are growing fast, especially in biotech and vaccines.

Q4: What makes Ireland and Belgium top exporters?

Ireland has tax advantages and skilled labor; Belgium excels in vaccine production and logistics.

Q5: Do these countries lead in R&D too?

Yes—especially the U.S., Germany, the UK, and Switzerland.

Q6: Did COVID-19 impact exports?

Absolutely. It spurred global demand, innovation, and investment in pharma manufacturing.

Q7: What role does the EU play in trade?

The EU ensures regulatory alignment, open borders, and trade support for member nations.

Numbers Source – World Population Review

Marvin O. Doran is a healthcare and life sciences research specialist with extensive experience in analyzing pharmaceutical pipelines, biotechnology breakthroughs, and medical device innovations. He writes data-driven, SEO-optimized market reports and in-depth company profiles to help industry professionals, investors, and researchers stay informed about the latest trends in global healthcare markets.