The payments industry is experiencing a revolution. From tap-to-pay technology at your local coffee shop to instant cross-border transactions, the way we exchange value is transforming at an unprecedented pace. At the heart of this transformation are Payments Innovation Managers—the architects of tomorrow’s financial infrastructure who blend technical knowledge, creative problem-solving, and strategic thinking to reimagine how money moves in the digital age.

If you’re exploring careers in fintech or looking to pivot into payments innovation, this comprehensive guide will help you understand the landscape of Payments Innovation Manager jobs, what it takes to succeed, and how to position yourself for this dynamic career path.

Understanding the Payments Innovation Manager Role

A Payments Innovation Manager occupies a unique space in the organizational structure—part strategist, part product developer, and part technologist. While similar to the Head of Payment Innovation role in focus areas, the manager-level position is more hands-on with execution, often leading specific innovation initiatives rather than setting enterprise-wide payment strategy.

Core Focus Areas

Product Innovation and Development Payments Innovation Managers are deeply involved in bringing new payment products from concept to market. This includes developing mobile wallets, implementing buy-now-pay-later solutions, creating cryptocurrency payment options, or building instant payment capabilities. You’ll work alongside engineers, designers, and business stakeholders to ensure innovations meet market needs while maintaining technical feasibility.

Process Optimization Beyond new products, these managers identify opportunities to improve existing payment processes. This might involve reducing payment processing times, decreasing transaction costs, improving authorization rates, or enhancing the customer payment experience through better UX design and reduced friction.

Technology Evaluation and Implementation A critical responsibility involves staying current with emerging payment technologies and determining which ones deserve investment. Should your company adopt a particular payment gateway? Is now the right time to implement tokenization? What about exploring central bank digital currencies or stablecoin settlements? These decisions fall within the Payments Innovation Manager’s purview.

Stakeholder Management and Cross-Functional Collaboration Innovation doesn’t happen in isolation. Payments Innovation Managers coordinate between engineering teams, compliance departments, marketing, customer service, and executive leadership to ensure payment innovations align with business objectives and regulatory requirements while delivering value to end-users.

Day-to-Day Responsibilities

Research and Market Analysis

Your mornings might start with scanning industry publications, analyzing competitor payment offerings, or reviewing the latest fintech startup announcements. Staying informed about regulatory changes—like updates to PSD3 in Europe or new guidance from the Consumer Financial Protection Bureau—is essential to ensuring your innovations remain compliant.

Project Management and Coordination

Much of your day involves managing ongoing innovation projects. You’ll conduct stand-up meetings with development teams, review wireframes with UX designers, discuss technical architecture with engineers, and update stakeholders on project timelines and milestones.

Testing and Iteration

Payments Innovation Managers oversee pilot programs and beta tests for new payment features. This includes analyzing user feedback, reviewing transaction data, identifying bugs or user experience issues, and working with teams to iterate and improve before full-scale launch.

Documentation and Reporting

Creating business cases for new payment initiatives, documenting technical specifications, preparing executive presentations, and maintaining innovation roadmaps are regular tasks. You’ll need to articulate complex payment concepts to audiences ranging from technical teams to non-technical executives.

Vendor and Partner Management

Many payment innovations involve third-party relationships. You might evaluate payment service providers, negotiate integration terms with fintech platforms, or coordinate with card networks on new acceptance capabilities.

Skills That Set You Apart

Technical Competencies

Payment Systems Knowledge Understanding the full payment ecosystem is fundamental. This includes knowledge of:

- Card network operations (Visa, Mastercard, American Express, Discover)

- ACH and wire transfer systems

- Real-time payment networks (RTP, FedNow, SEPA Instant)

- Alternative payment methods (digital wallets, QR codes, account-to-account transfers)

- Payment security standards (PCI DSS, 3D Secure, tokenization)

- API integration and payment orchestration platforms

Emerging Technology Awareness Familiarity with cutting-edge payment technologies gives you a competitive advantage:

- Blockchain fundamentals and cryptocurrency payment processing

- Artificial intelligence applications in fraud detection and payment routing

- Biometric authentication methods

- Internet of Things (IoT) payment integrations

- Machine learning for payment optimization

Data Analytics Capabilities The ability to analyze payment data, identify trends, and extract actionable insights is increasingly important. Basic proficiency with SQL, data visualization tools like Tableau or Power BI, and understanding of key payment metrics (authorization rates, conversion rates, payment success rates, chargebacks) will serve you well.

Apply Now

Business and Strategic Skills

Product Management Fundamentals Many Payments Innovation Managers come from product management backgrounds. Skills in:

- Defining product requirements and user stories

- Creating and managing product roadmaps

- Conducting user research and testing

- Prioritizing features using frameworks like RICE or MoSCoW

- Agile and Scrum methodologies

Financial Acumen Understanding payment economics—interchange fees, processing costs, revenue models, and pricing structures—helps you build business cases and demonstrate ROI for innovation initiatives.

Regulatory and Compliance Knowledge While you won’t be a compliance expert, familiarity with regulations affecting payments is crucial:

- Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements

- Payment Services Directive (PSD2/PSD3) in Europe

- Electronic Fund Transfer Act (EFTA) and Regulation E in the US

- General Data Protection Regulation (GDPR) and data privacy laws

- Licensing requirements for payment operations

Soft Skills That Matter

Communication Excellence You’ll regularly translate between technical and business languages, present to senior executives, write clear documentation, and facilitate discussions between diverse stakeholders. Clear, persuasive communication is non-negotiable.

Creative Problem-Solving Payment innovation requires thinking beyond conventional solutions. The best managers approach problems with curiosity, question assumptions, and aren’t afraid to experiment with unconventional approaches.

Adaptability and Learning Agility The payments landscape changes rapidly. Your willingness to continuously learn new technologies, adapt to regulatory changes, and pivot strategies based on market feedback will determine your long-term success.

Collaboration and Influence Since innovation requires buy-in from multiple stakeholders, your ability to build relationships, navigate organizational politics, and influence without direct authority is critical.

Educational Background and Experience

Typical Educational Paths

Undergraduate Degrees Most Payments Innovation Managers hold bachelor’s degrees in:

- Business Administration or Finance

- Computer Science or Information Technology

- Economics

- Engineering

- Marketing or Communications

Advanced Degrees (Beneficial but Not Always Required)

- MBA with focus on Technology, Innovation, or Finance

- Master’s in Financial Technology (FinTech)

- Master’s in Information Systems or Computer Science

- Master’s in Innovation Management

Professional Experience

Entry-Level Foundation (2-4 years) Building toward a Payments Innovation Manager role typically starts with positions like:

- Payment Analyst

- Associate Product Manager in payments

- Business Analyst at payment companies

- Junior Developer on payment systems

- Operations roles at payment processors

Mid-Level Experience (5-7 years) Before moving into innovation management, candidates often hold roles such as:

- Senior Payment Product Manager

- Payment Operations Manager

- Technical Project Manager for payment systems

- Senior Business Analyst focused on payments

- Product Owner for payment teams

Transition to Payments Innovation Manager The jump to innovation management usually requires:

- Demonstrated track record of successful payment projects

- Experience with at least one major payment innovation (new product launch, system migration, technology implementation)

- Cross-functional leadership experience

- Understanding of end-to-end payment lifecycles

Industry Sectors Hiring Payments Innovation Managers

Financial Institutions

Traditional Banks Major banks are investing heavily in digital transformation and need innovation managers to modernize payment infrastructure, launch digital banking features, and compete with agile fintech challengers.

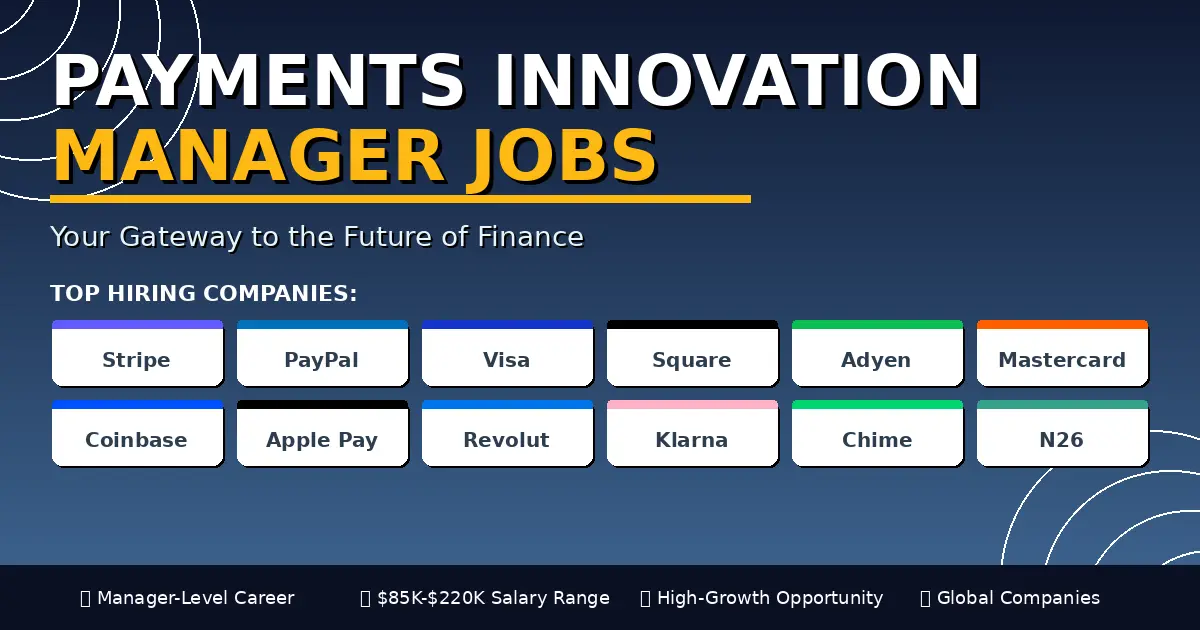

Digital Banks and Neobanks Companies like Chime, Revolut, N26, and Nubank are built on innovative payment experiences and constantly seek managers who can push boundaries further.

Credit Unions Even smaller financial institutions are prioritizing payment innovation to serve members better and remain competitive.

Fintech Companies

Payment Processors and Gateways Companies like Stripe, Adyen, Square, and PayPal are perpetually innovating and need managers who understand both merchant and consumer payment needs.

Digital Wallet Providers Apple Pay, Google Pay, Samsung Pay, and emerging wallet platforms require innovation talent to develop new features and expand use cases.

Peer-to-Peer Payment Platforms Venmo, Cash App, Zelle, and international P2P platforms need innovation managers to enhance functionality and grow user bases.

E-Commerce and Retail

Online Marketplaces Amazon, eBay, Etsy, and other marketplaces constantly optimize payment checkout experiences and explore new payment methods to reduce cart abandonment.

Omnichannel Retailers Companies with both physical and digital presence need managers who can create seamless payment experiences across all channels.

Technology Giants

Big Tech in Finance Apple, Google, Amazon, Meta, and Microsoft are expanding financial services offerings and need payment innovation expertise.

Emerging Sectors

Cryptocurrency and Blockchain Companies Coinbase, Binance, and blockchain payment infrastructure companies seek managers who understand both traditional and crypto payments.

Embedded Finance Platforms Companies helping non-financial businesses integrate payment capabilities need innovation managers familiar with API platforms and integration strategies.

Gaming and Virtual Worlds Gaming companies and metaverse platforms are innovating in virtual goods payments and in-game economies.

Salary Expectations for Payments Innovation Managers

Compensation varies significantly based on location, company size, industry sector, and experience level.

United States

Major Tech Hubs (San Francisco, New York, Seattle)

- Base Salary: $110,000 – $160,000

- Total Compensation (with bonus and equity): $130,000 – $220,000

Secondary Markets (Austin, Denver, Boston)

- Base Salary: $95,000 – $140,000

- Total Compensation: $115,000 – $185,000

Other US Markets

- Base Salary: $85,000 – $130,000

- Total Compensation: $100,000 – $170,000

International Markets

United Kingdom

- Base Salary: £70,000 – £95,000

- Total Compensation: £85,000 – £130,000

European Union

- Germany/France: €75,000 – €105,000

- Netherlands/Sweden: €70,000 – €100,000

Asia-Pacific

- Singapore: SGD 100,000 – 160,000

- Australia: AUD 110,000 – 150,000

- Hong Kong: HKD 700,000 – 1,100,000

Benefits often include:

- Performance bonuses (10-20% of base salary)

- Equity/stock options in growth companies

- Professional development budgets

- Remote work flexibility

- Health insurance and retirement contributions

Current Trends Impacting the Role

The Rise of Real-Time Payments

The global shift toward instant payments is creating massive opportunities for innovation managers. In the US, FedNow’s launch in 2023 is still driving implementation efforts across financial institutions. Globally, real-time payment networks are becoming the standard, requiring managers who can navigate technical integration while creating compelling use cases.

Open Banking and Financial Data Sharing

Open banking regulations are opening new possibilities for payment initiation, account-to-account transfers, and consent-based data sharing. Payments Innovation Managers are crucial in exploring these opportunities while ensuring customer data protection and regulatory compliance.

Cryptocurrency Integration Challenges

While crypto adoption continues, it remains complex. Innovation managers must balance customer interest in cryptocurrency payments with regulatory uncertainty, volatility concerns, and technical integration challenges.

AI and Machine Learning Applications

Artificial intelligence is transforming payment operations through:

- Intelligent fraud detection that reduces false positives

- Dynamic payment routing to optimize authorization rates

- Personalized payment recommendations based on user behavior

- Predictive analytics for cash flow management

The Buy Now, Pay Later Boom

BNPL services have exploded, with providers like Klarna, Affirm, and Afterpay becoming mainstream. Innovation managers are exploring embedded BNPL at checkout, responsible lending practices, and integration with existing payment flows.

Sustainability in Payments

Environmental considerations are entering payment innovation. From carbon-neutral transaction processing to sustainable card materials and offsetting payment-related emissions, green payments are emerging as a focus area.

Finding Payments Innovation Manager Jobs

Where to Look

Specialized Fintech Job Boards

- FinTech Futures Jobs

- PaymentSource Career Center

- The Fintech Times Job Board

- Crypto Jobs List (for blockchain payment roles)

General Tech Job Platforms

- LinkedIn (use filters for “payments” and “innovation”)

- AngelList/Wellfound (for startup opportunities)

- Built In (tech company job listings by city)

- Glassdoor (includes salary insights and company reviews)

Company Career Pages Directly check careers sections of leading payment companies:

- Stripe, Adyen, Square, PayPal

- Visa, Mastercard, American Express

- Coinbase, Ripple, Circle (for crypto payments)

- Major banks’ innovation and digital teams

Professional Networks

- Electronic Transactions Association (ETA)

- The Payments Association

- Women in Payments

- Local fintech meetups and conferences

Networking Strategies

Industry Events Attend conferences like:

- Money20/20 (global payment conferences)

- Fintech Meetup

- Seamless Payments

- Local fintech and payment industry gatherings

Online Communities Engage in:

- LinkedIn payment professional groups

- Substack newsletters focused on payments

- Twitter/X fintech and payments conversations

- Reddit communities like r/fintech and r/payments

Informational Interviews Reach out to current Payments Innovation Managers for coffee chats or virtual conversations to learn about their paths and companies.

How to Stand Out When Applying

Craft a Compelling Application

Tailor Your Resume Highlight:

- Specific payment projects you’ve worked on with measurable results

- Technologies and payment systems you’ve implemented

- Cross-functional leadership examples

- Innovation initiatives you’ve led or contributed to

Showcase Quantifiable Achievements Instead of “Worked on payment system upgrade,” write:

- “Led migration to new payment gateway, reducing transaction processing time by 40% and cutting costs by $200K annually”

- “Launched contactless payment feature adopted by 150,000 users within first quarter”

- “Improved payment authorization rates from 82% to 91% through intelligent retry logic”

Create a Portfolio Consider developing:

- Case studies of payment innovations you’ve been involved with

- Analysis of payment industry trends with your unique insights

- Concept designs for payment solutions you’d like to build

- Blog posts or articles demonstrating payment expertise

Ace the Interview

Prepare for Common Questions

Technical Questions:

- “Explain how a card payment transaction works from tap to settlement”

- “What payment methods would you prioritize for a European e-commerce business and why?”

- “How would you evaluate whether to build a payment feature in-house versus using a third-party solution?”

Strategic Questions:

- “What payment innovation do you think is overhyped and which is underrated?”

- “How would you approach launching a payment feature in a highly regulated market?”

- “If you had $500K to invest in payment innovation, where would you allocate it?”

Behavioral Questions:

- “Tell me about a time you had to convince stakeholders to support a risky innovation”

- “Describe a payment project that failed and what you learned”

- “How do you balance innovation speed with security and compliance requirements?”

Ask Insightful Questions

- “What payment innovations are currently in your roadmap?”

- “How does the innovation team interact with compliance and risk management?”

- “What’s the biggest payment challenge your customers face?”

- “How do you measure the success of payment innovations?”

Career Growth and Advancement

Progression Paths

Vertical Advancement

- Payments Innovation Manager → Senior Payments Innovation Manager

- Senior Manager → Director of Payment Innovation

- Director → VP of Payment Innovation

- VP → Head of Payment Innovation / Chief Payment Officer

Lateral Moves

- Transition to Product Management leadership for broader digital products

- Move into Payment Operations or Risk Management

- Pivot to Payment Consulting or Advisory roles

- Join venture capital firms as payment domain expert

Entrepreneurial Routes Many experienced Payments Innovation Managers eventually:

- Start their own payment technology companies

- Launch payment consulting firms

- Join early-stage fintech startups as founding team members

- Become independent advisors to payment companies

Skills to Develop for Advancement

Deepen Technical Expertise Pursue certifications like:

- Certified Payments Professional (CPP)

- Certified Treasury Professional (CTP)

- Payment Card Industry certifications

- Cloud architecture certifications (AWS, Google Cloud)

Expand Business Acumen Develop understanding of:

- P&L management and budget oversight

- Vendor contract negotiation

- Strategic planning and vision setting

- Change management and organizational transformation

Build Leadership Capabilities Grow your ability to:

- Manage and mentor larger teams

- Influence executive-level decisions

- Drive organizational change

- Communicate vision to diverse audiences

The Future Outlook for Payments Innovation Manager Jobs

The demand for Payments Innovation Managers shows no signs of slowing. Several factors ensure continued growth:

Digital Payment Adoption As cash usage declines globally and digital payment methods proliferate, organizations need innovation talent to navigate the expanding payment landscape.

Regulatory Evolution New regulations like PSD3, MiCA (Markets in Crypto-Assets Regulation), and evolving data privacy laws create both challenges and opportunities requiring skilled managers to address.

Emerging Technologies Quantum computing’s implications for payment security, artificial intelligence applications, and new blockchain use cases will require managers who can evaluate and implement these technologies.

Financial Inclusion Initiatives Efforts to bring unbanked and underbanked populations into the formal financial system create opportunities for payment innovations in underserved markets.

Cross-Border Payment Transformation The persistent challenges of international payments—high costs, slow settlement times, lack of transparency—represent a massive opportunity for innovation.

Real-World Success Stories

From Analyst to Innovation Leader Sarah started as a payment analyst at a regional bank, where she noticed inefficiencies in the ACH processing system. She proposed and led an automation initiative that saved 200 hours of manual work monthly. This success led to her promotion to Payments Innovation Manager, where she now leads the bank’s digital wallet strategy. Her advice: “Don’t wait for permission to innovate. Find problems and propose solutions, even if it’s not officially your job.”

The Technical Pivot Marcus worked as a software engineer at a payment processor before transitioning to a Payments Innovation Manager role. His technical background gave him credibility when evaluating new technologies, but he had to develop product management and business skills. He credits online courses, mentorship from product leaders, and volunteering to lead cross-functional projects for his successful transition.

The Startup Journey After five years managing payment innovation at a major bank, Priya joined an early-stage fintech startup as their first Payments Innovation Manager. The role required wearing multiple hats—product manager, project manager, and technical architect—but the experience was invaluable. She now leads a team of eight and has equity in a company valued at over $100M.

Taking Action: Your Next Steps

Ready to pursue Payments Innovation Manager jobs? Here’s your action plan:

Immediate Actions (This Week)

- Update your LinkedIn profile highlighting any payment-related experience

- Follow top payment companies and innovation leaders on social media

- Subscribe to payment industry newsletters (The Interchange, PaymentsJournal, Finextra)

- Review job descriptions for Payments Innovation Manager roles to identify skill gaps

Short-Term Goals (This Month)

- Take an online course on payment systems or fintech fundamentals

- Attend a local fintech meetup or virtual payment industry event

- Reach out to two Payments Innovation Managers for informational interviews

- Read key payment industry reports from firms like McKinsey, Accenture, or EY

Medium-Term Objectives (This Quarter)

- Work on a payment-related project in your current role, even if tangential

- Obtain a relevant certification (CPP or similar)

- Write an article or LinkedIn post about a payment trend you find interesting

- Apply to 5-10 Payments Innovation Manager positions

Long-Term Development (This Year)

- Build a portfolio of payment innovation concepts or case studies

- Develop proficiency in a key technical skill (SQL, API integration, data analysis)

- Establish yourself as a thought contributor in payment communities

- Network consistently and maintain relationships with payment professionals

Conclusion: Building the Future of Money

Payments Innovation Manager jobs offer a unique opportunity to shape how billions of people and businesses exchange value. This role sits at the intersection of technology, finance, user experience, and business strategy—providing intellectual challenge, tangible impact, and strong career prospects.

The payment industry doesn’t just need managers who can execute existing strategies. It needs creative thinkers who question conventions, technical experts who understand implementation realities, and strategic minds who can envision payment experiences we haven’t yet imagined.

Whether you’re early in your career and building toward this role, actively searching for Payments Innovation Manager opportunities, or a hiring manager looking to understand what makes great candidates, remember this: the most successful payment innovators combine deep curiosity about how things work with genuine empathy for user needs. They stay current with technology while understanding that innovation serves people, not the other way around.

The future of payments is being built right now. The question isn’t whether there will be opportunities for Payments Innovation Managers—it’s whether you’ll be one of the people creating that future.

Start your journey today. The payments revolution is waiting for innovative minds like yours.

Ready to launch your career in payments innovation? Connect with payment professionals on LinkedIn, explore job opportunities at leading fintech companies, and invest in developing the skills that will make you indispensable in this dynamic field. Your next role could be defining the next generation of payment experiences.

Marvin O. Doran is a healthcare and life sciences research specialist with extensive experience in analyzing pharmaceutical pipelines, biotechnology breakthroughs, and medical device innovations. He writes data-driven, SEO-optimized market reports and in-depth company profiles to help industry professionals, investors, and researchers stay informed about the latest trends in global healthcare markets.