Global Leaders in Healthcare Innovation

The pharmaceutical industry continues to be a cornerstone of global health and economic development. In 2024, the world’s top pharmaceutical companies have not only delivered breakthrough treatments but also generated impressive revenues, highlighting their dominance in a highly competitive market.

This article breaks down the top 10 pharmaceutical companies by 2024 revenue, offering insights into where they are headquartered, how much they earned, and what drives their success in a rapidly evolving industry.

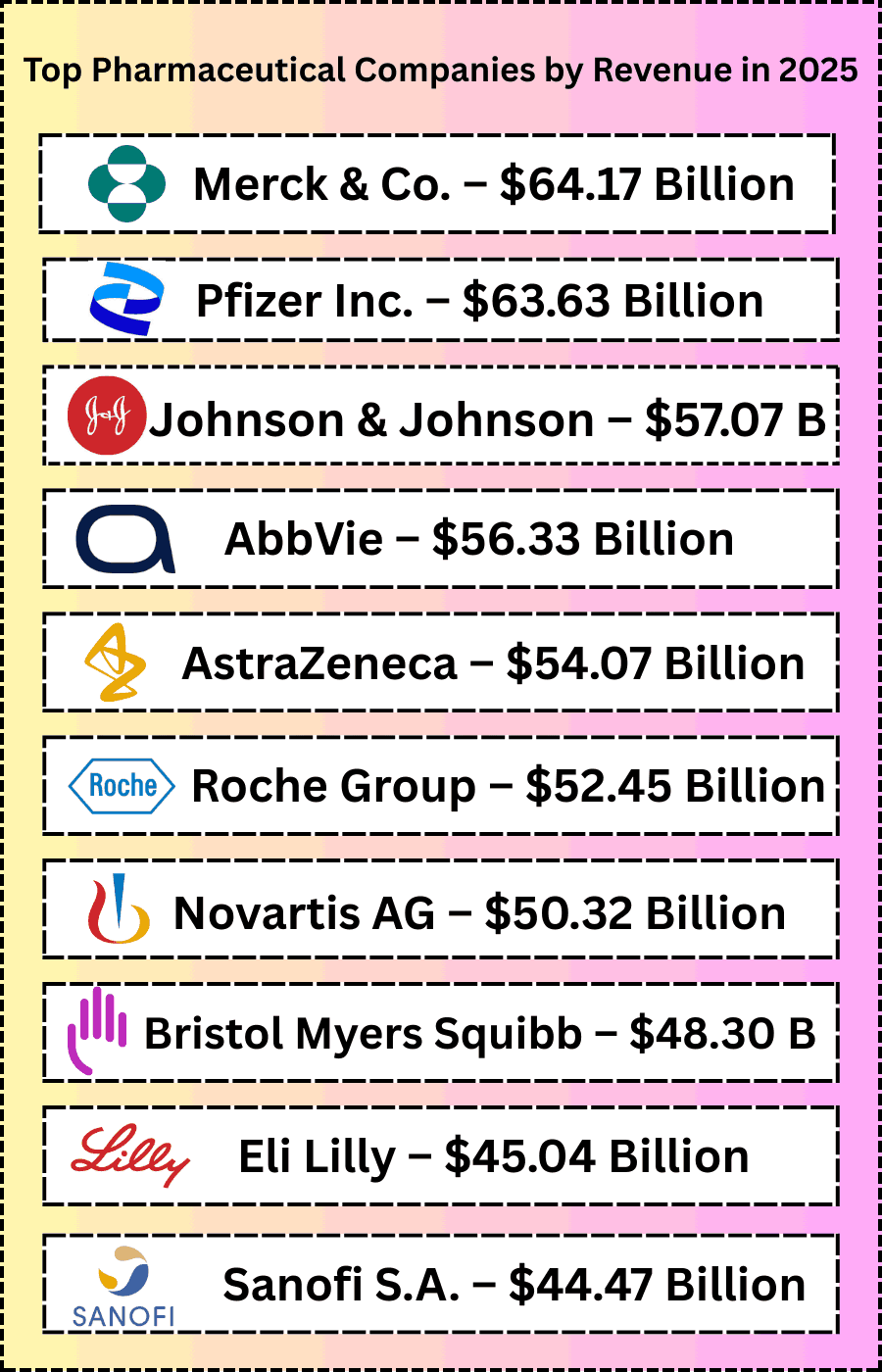

Top Pharmaceutical Companies by 2024 Revenue

| Rank | Company | Headquarters | 2024 Revenue (USD) |

| 1 | Merck & Co. | USA | $64.17 Billion |

| 2 | Pfizer Inc. | USA | $63.63 Billion |

| 3 | Johnson & Johnson | USA | $57.07 Billion |

| 4 | AbbVie | USA | $56.33 Billion |

| 5 | AstraZeneca | United Kingdom | $54.07 Billion |

| 6 | Roche Group | Switzerland | $52.45 Billion |

| 7 | Novartis AG | Switzerland | $50.32 Billion |

| 8 | Bristol Myers Squibb | USA | $48.30 Billion |

| 9 | Eli Lilly USA | USA | $45.04 Billion |

| 10 | Sanofi S.A. | France | $44.47 Billion |

Top Pharmaceutical Companies by Revenue in 2025

1. Merck & Co. – $64.17 Billion

Merck tops the list in 2024, driven by strong performance in oncology and vaccines. The company’s blockbuster cancer drug, Keytruda, continues to lead sales globally, while its R&D pipeline remains robust across multiple therapeutic areas.

2. Pfizer Inc. – $63.63 Billion

Pfizer’s consistent revenue stream comes from a diverse portfolio, including vaccines, oncology, and internal medicine. Following the global success of its COVID-19 vaccine, Pfizer continues to capitalize on mRNA technology and immunotherapies.

3. Johnson & Johnson – $57.07 Billion

A healthcare conglomerate with operations in pharmaceuticals, medical devices, and consumer health, Johnson & Johnson remains a powerhouse. Its pharmaceutical division is known for innovations in immunology, neuroscience, and oncology.

4. AbbVie – $56.33 Billion

AbbVie continues to post strong revenue growth, fueled by its flagship immunology drug Humira, complemented by rising demand for newer treatments such as Rinvoq and Skyrizi. Its acquisition of Allergan also expanded its reach in aesthetics and neuroscience.

5. AstraZeneca plc – $54.07 Billion

AstraZeneca continues its rise with a strong portfolio in oncology, cardiovascular, and respiratory treatments. The UK-based firm has also invested heavily in biologics and rare disease therapies through strategic acquisitions.

6. Roche Group – $52.45 Billion

Based in Switzerland, Roche is renowned for its diagnostics and biologics. With strong contributions from oncology drugs like Avastin and immunotherapy treatments, Roche is also expanding its digital health capabilities.

7. Novartis AG – $50.32 Billion

Novartis, another Swiss giant, saw consistent growth driven by its innovative medicines and generics division, Sandoz. The company is investing in gene therapies, cell therapies, and biosimilars to stay ahead in the global market.

8. Bristol Myers Squibb – $48.30 Billion

Bristol Myers Squibb continues to strengthen its oncology and immunology portfolios. Drugs like Opdivo and Revlimid have positioned the company as a key player in cancer treatment and hematology.

9. Eli Lilly – $45.04 Billion

Eli Lilly has gained major traction in diabetes and obesity treatments, particularly with its GLP-1 drugs like Mounjaro. The company is also expanding its presence in neuroscience and oncology, driving further growth.

10. Sanofi S.A. – $44.47 Billion

Sanofi rounds out the top 10 with strong performance in vaccines, rare diseases, and immunology. Based in France, Sanofi has also focused on R&D partnerships and pipeline development in mRNA and oncology.

Key Trends Behind 2024’s Pharma Giants

Several trends explain the continued growth of these top pharmaceutical companies:

- Innovation in Oncology & Immunology: Targeted cancer therapies and autoimmune treatments continue to drive revenue.

- Biologics & Biosimilars: Companies are investing heavily in biologics, with biosimilars offering lower-cost alternatives.

- Strategic M&A Activity: Acquisitions like AbbVie-Allergan and AstraZeneca-Alexion are reshaping the industry.

- mRNA & Next-Gen Technologies: Following the success of COVID-19 vaccines, firms like Pfizer and Sanofi are expanding mRNA applications.

- Global Expansion: Emerging markets are becoming key growth areas, especially for chronic disease treatments and vaccines.

Frequently Asked Questions (FAQ)

Q2: How many of the top 10 pharma companies are based in the United States?

Six out of the top ten—Merck, Pfizer, Johnson & Johnson, AbbVie, Bristol Myers Squibb, and Eli Lilly—are headquartered in the United States, reflecting the country’s dominance in pharmaceutical innovation and production.

Q3: What sectors contributed most to pharma revenues in 2024?

Oncology, immunology, and vaccines were the primary revenue drivers in 2024. Companies that invested in biologics, mRNA technology, and chronic disease treatments saw substantial growth.

Q4: Why did AstraZeneca and Sanofi perform so well in 2024?

AstraZeneca saw strong growth from its oncology and rare disease portfolios, while Sanofi benefited from its leadership in vaccines and expanding pipeline in immunology and mRNA development.

Q5: Are any Swiss companies in the top 10?

Yes, Roche Group and Novartis AG, both headquartered in Switzerland, ranked sixth and seventh respectively. They are global leaders in biologics, diagnostics, and innovative therapies.

Q6: What trends are shaping the pharmaceutical industry right now?

Key trends include personalized medicine, increased R&D in gene and cell therapy, digital health integration, and expansion into emerging markets.

Q7: How is mRNA technology influencing pharma growth post-COVID?

mRNA has shifted from vaccines to broader applications in cancer, infectious diseases, and genetic disorders. Pfizer and Sanofi are actively investing in this technology for future drug development.

Q8: Which company is leading in diabetes and obesity treatments?

Eli Lilly is at the forefront, with strong revenue from its GLP-1 class drugs like Mounjaro, making it a leader in diabetes and metabolic disease management.

Read More …

Top Pharmaceutical Exporting Countries in 2025

Top 10 Cancer Drug Leaders Sales of 2024 | Revenue Data

Top Selling Drugs of 2024: Blockbusters Driving the Pharma Boom

Pharmacovigilance Jobs Available Globally| Remote | WFO

Marvin O. Doran is a healthcare and life sciences research specialist with extensive experience in analyzing pharmaceutical pipelines, biotechnology breakthroughs, and medical device innovations. He writes data-driven, SEO-optimized market reports and in-depth company profiles to help industry professionals, investors, and researchers stay informed about the latest trends in global healthcare markets.